Blog

26 Apr, 2024

2-10 Home Buyers Warranty® has selected Lacrosse Homes as a recipient of the prestigious Lifetime Achievement Award honoring the builder with a “Foundation Builder” Award for longstanding, outstanding performance and overall excellence in the home building industry. “We’re honored to receive this lifetime achievement award from such a widely esteemed firm such as 2-10 Home Buyers Warranty,” said Lindsay Dixon president of Lacrosse Homes. “We appreciate the recognition, and this award is a testament to the hard work and dedication of the entire team at Lacrosse Homes.” According to 2-10 Home Buyers Warranty, the highly acclaimed award is reserved for builders that “demonstrate a steadfast commitment to building a business based on integrity, trust and reliability.” Lacrosse Homes is honored for their “steadfast commitment to improving the housing industry while providing exceptional customer service and protection,” continued 2-10. You can read more about the award here . The best foundation starts with Lacrosse Homes. If you’re interested in building a home on your lot, or in one of our fine communities, we would love to talk to you. Contact us today.

26 Mar, 2024

Quality of life is always something to reflect on, and where you live presents many factors that can affect that quality. In addition to significant and lasting changes in workforce requirements because of the COVID-19 pandemic, we’re seeing broad interest in homebuyers looking to move a bit farther afield …some call it an urban exodus, we call it a desire for small-town charm! Two of our newest Coming Soon communities – Foxx Farm in Sudlersville Md and Meadow Creek in Centreville Md are answering the call for those who choose to set roots down in a location that better aligns with their budget and their lifestyle choices while prioritizing peace and quiet over expense and crowds. Here are a few reasons why many consider it great to live in a small town: Sense of Community: Those tight-knit, supportive neighbors are more prevalent in small towns. Residents tend to know each other, and there's a greater chance of forming close connections with neighbors. Lower Cost of Living: Small towns generally have a lower cost of living compared to larger cities. We’ve found that building the exact same house in more suburban locales increases the price by as much as $100,000! In addition to housing costs, groceries, and other daily expenses may be more affordable, allowing you to save money or allocate resources to other priorities. Quiet and Peaceful Lifestyle: If you prefer a slower pace with less noise and congestion, a small town is typically a quieter and more peaceful environment. Natural Beauty: Many small towns are surrounded by scenic landscapes and natural beauty. Residents often have easy access to outdoor activities, contributing to a healthier and more active lifestyle. Case in point, at Foxx Farm , residents will live across from Sudlersville Park , a 36-acre facility with ball fields, pickleball, tennis, trails, and more! Less Traffic: Small towns typically have less traffic and congestion resulting in a less stressful commute and an overall more relaxed way of life. Safer Environment: Smaller communities tend to have lower crime rates compared to larger urban areas. This can contribute to a sense of safety and security for residents. Local Traditions: Who doesn’t love a holiday parade with firetrucks? Small towns often have strong local traditions, active community associations, and events that bring residents together. Festivals, parades, and other celebrations create a unique and enjoyable atmosphere the entire family can enjoy. If a small-town lifestyle sounds ideal to you, consider exploring Foxx Farm in historic Sudlersville. The master plan for the 90-acre property will consist of 98 luxury garage townhomes and 129 single-family detached residences. We’ve worked closely with the Town to create a special community that enhances the unique character and charm of Sudlersville. Our goal is to create a one-of-a-kind neighborhood for area residents as well as provide a positive economic boost for local businesses, enhance property values of area residents, and preserve the historic presence of Sudlersville. If you’re searching for a home with a bit more space to spread out, Meadow Creek in Queen Anne’s County will provide the perfect place to build your dream home on the Eastern Shore. Offering just 16 one-acre homesites, this prime Centreville location is a short drive from Kent Island and the Chesapeake Bay. Visit LaxHomes.com to register for advance information on these new communities or call our sales team at 410-604-3701 to add your name to the interest list.

By Bruce Orr

•

11 Jan, 2024

The Eastern Shore of Maryland is a beautiful place to call home, with its picturesque landscapes and charming communities. However, living in this region also means experiencing the full force of winter, complete with freezing temperatures, snowstorms, and icy conditions. To ensure your comfort and safety during the coldest months of the year, it's crucial to prepare your Eastern Shore home for extreme winter conditions. Let’s dive into the differences between a newer home and an older home and then review some tips/advice to help safeguard your home against the harsh winter elements. New Home vs. Older Home: Winter Preparation Preparing a new home for winter can be a more straightforward process compared to an older home. New homes often come with the advantage of modern construction techniques and materials designed to meet or exceed energy efficiency standards. They typically have better insulation, more energy-efficient windows, and airtight seals. However, that doesn't mean new homes are entirely immune to winter challenges. It's still essential to perform routine maintenance, service your heating system, and prepare for emergencies. In contrast, older homes may require more extensive winterization efforts. They might have outdated insulation, drafty windows, or aging heating systems that are less efficient. If you live in an older home, consider investing in upgrades like new windows, improved insulation, and a more energy-efficient heating system. These enhancements not only make your home cozier but can also lead to long-term energy savings. Additionally, regular inspections for structural integrity are crucial, as older homes may have vulnerabilities that need addressing before winter's harsh conditions arrive. By understanding the unique needs of your new or older home, you can take the appropriate steps to ensure it remains comfortable and resilient throughout the winter months. Preparation Considerations Insulate Your Home Proper insulation is the first line of defense against cold weather. Make sure your home is adequately insulated to keep the warmth inside and the cold air out. Inspect your windows, doors, walls, and attic for any gaps or leaks and seal them. Consider adding extra insulation to your attic and crawl spaces if needed. Proper insulation not only keeps your home cozy but also saves on heating costs. Service Your Heating System Before winter arrives, it's essential to have your heating system serviced by a professional HVAC technician. A well-maintained furnace or heating system will operate efficiently and keep your home warm without any unexpected breakdowns. Change air filters regularly to ensure proper airflow and replace any worn-out parts. Protect Your Pipes Frozen pipes are a common issue during Eastern Shore winters. To prevent pipes from freezing and bursting, insulate them with pipe insulation or heat tape. Allow a slow trickle of water to run through faucets during extremely cold nights to keep the water flowing. Drain outdoor faucets and disconnect hoses to prevent water from freezing and causing damage. Winterize Your Landscaping Preparing your yard for winter is just as important as prepping the inside of your home. Trim trees and bushes away from your house to prevent snow and ice from causing damage. Remove dead branches that could fall during a storm and damage your property. If you have a garden, consider covering delicate plants or moving them indoors. Seal Drafts Drafts can be a significant source of heat loss in your home. Check for drafts around windows and doors and seal them with weather-stripping or caulking. This simple step can make a big difference in maintaining a comfortable indoor temperature. Emergency Supplies Prepare an emergency kit in case of power outages or severe winter storms. Include items like flashlights, candles, blankets, non-perishable food, and a battery-operated radio. Make sure you have a backup generator or a plan for alternative heating methods like a wood-burning stove if the power goes out. Snow Removal Invest in quality snow removal equipment like shovels, snow blowers, and de-icing materials. Keeping driveways and walkways clear of snow and ice is not only essential for safety but also for maintaining your home's exterior. Roof Inspection A roof covered in heavy snow can lead to structural damage or leaks. Before winter arrives, have your roof inspected for any loose shingles or weak spots. Make necessary repairs to ensure it can withstand the weight of accumulated snow. Living on Maryland's Eastern Shore provides a unique opportunity to enjoy the beauty of all four seasons. However, winter can be particularly challenging if your home is not adequately prepared. By following these tips, you can ensure your Eastern Shore home is ready to withstand extreme winter conditions. A well-insulated, well-maintained, and well-prepared home will not only keep you warm and comfortable but also protect your investment for years to come. Stay safe, stay warm, and enjoy the beauty of winter on the Eastern Shore!

16 Nov, 2023

As noted on the Town website, “The community that was to become Sudlersville took root in 1740 when Joseph Sudler, a Kent Island landowner, purchased 800 acres south of the Chester River. The land included the homestead known as Sledmore, which had been built in 1713. By the mid-1800s, the village had 15 houses, a general store, a Methodist Church, and a blacksmith. At the end of the century, there were about 40 houses and an assortment of commercial, ecclesiastical, and educational institutions. One of those was the Asbury Methodist Episcopal Church, which now houses the Sudlersville Memorial Library.” Lacrosse Homes is a Maryland-based privately held company that has built townhomes and single-family homes for over 25 years. They are known for successful developments such as Ellendale at Kent Island as well as Ashby Commons, a community of townhomes and single-family homes in historic Easton, Md. “We are pleased to bring our decades of experience and success to Foxx Farm,” said Lindsay Dixon president of Lacrosse Homes. “This is an exciting opportunity for the town of Sudlersville. The master plan for the 90-acre Foxx Farm consists of 98 luxury garage townhomes and 129 single-family detached residences. We’ve worked closely with the Town to create a special community that enhances the unique character and charm of Sudlersville while providing the most up-to-date new home designs. Our goal is to create a one-of-a-kind neighborhood for area residents as well as provide a positive economic boost for local businesses, enhance property values of area residents, and preserve the historic presence of Sudlersville.” Foxx Farm is named in honor of Jimmie Foxx , the “Sudlersville Slugger” Hall of Fame baseball player who hailed from the small town and was the greatest right-handed slugger of his time. Located in Queen Anne’s County south of the Chester River and in Maryland's bucolic Eastern Shore Foxx Farm is a short 15-minute drive to Middletown, DE, close to major commuting routes such as 301 and puts work and leisure within easy reach. The community is situated directly across from Sudlersville Park offering over 36 acres of activities such as Baseball, Basketball, Pickleball, Soccer, Tennis, Trails, Picnic areas, and more. Sales at Foxx Farm are expected to start in January 2024 with the release of homes in Phase I of the development. Those interested in further information are asked to register on our website to receive updates as news develops.

04 Oct, 2023

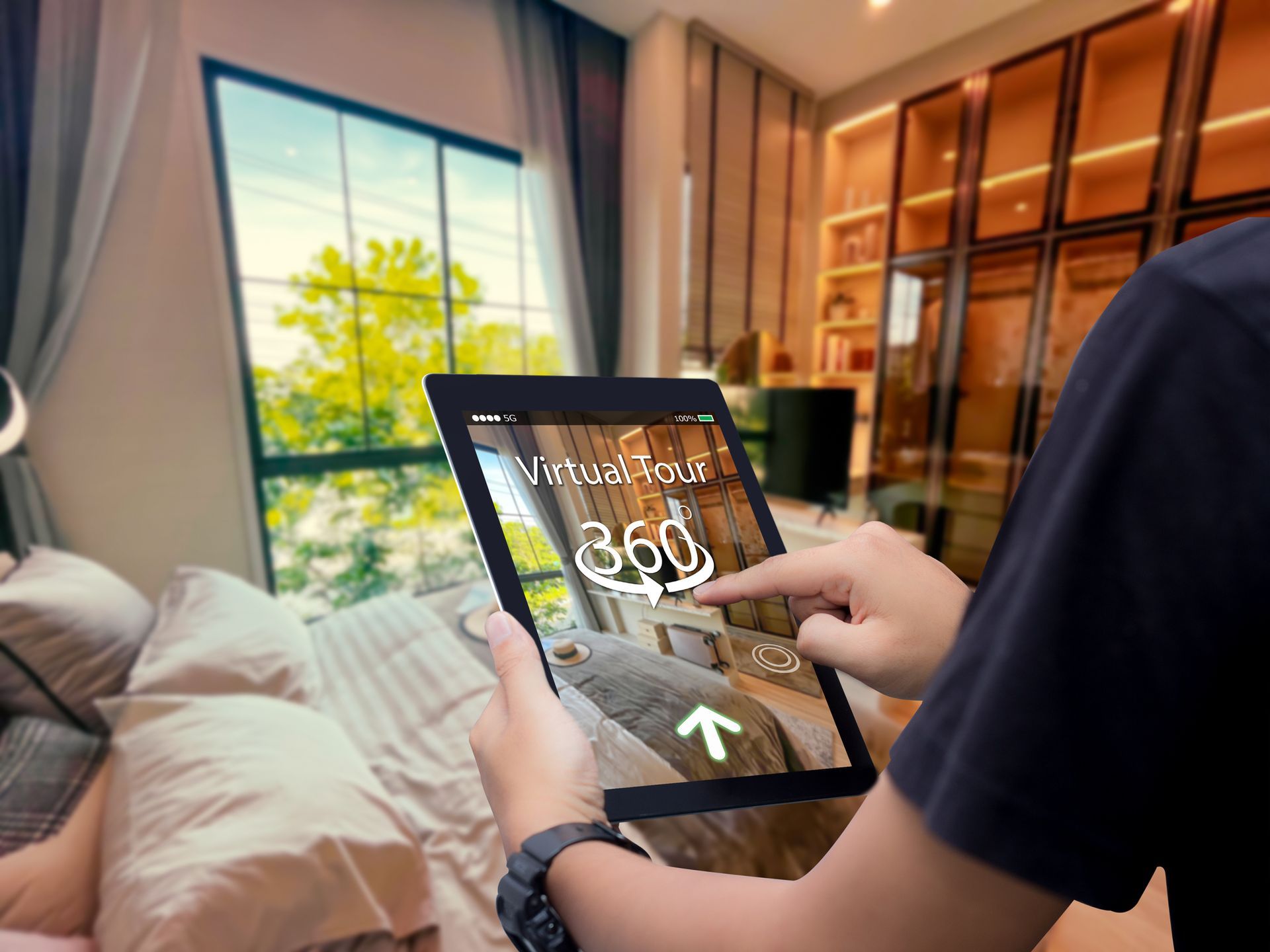

Touring a new home via a 360 virtual, 3D tour is a fast and very efficient way to ascertain if a home's design meets your needs even before taking the step to visit in person! In today's fast-paced, hectic world, finding a way to search for your new home with less stress is definitely a plus!! We know that you lead a busy life, that you are pulled from here to there and may not have time to stop by one of our model homes in our sought-after communities in Maryland. Tour one of our magnificent model homes today through our virtual tours from the comfort of your own home. From your smart phone or desktop you can easily immerse yourself in a Lacrosse home interior. From the front door to each level, and every vantage point you can imagine, our homes will come to life when using our 3D tours. Here you can view our dedication to quality construction and get a feel for the flow of the house at the pace you set for yourself. Discover why Lacrosse Homes is one of the top home builders in Maryland with our 3D virtual home tours .

28 Aug, 2023

We recently read this great article that provides historical insight on the rise and fall of mortgage rates. The commentary below is from Freddie Mac - The Federal Home Loan Mortgage Corporation (FHLMC): We've all heard that mortgage rates are going up these days, particularly from where they were during the pandemic. When it comes to something as abstract as a mortgage rate, how high is actually high? How low is low? Even with the recent increases, you might be surprised to know that mortgages today are actually right around the historical average. For this article, we'll take a look back at the rise and fall of mortgage rates over the years, discussing the literal highs and lows of our timeline, then a look at where we are currently. Lastly, we'll talk about refinancing, and how the current mortgage rate doesn't always tell the whole story. With that in mind, let's dive in. What is the historical average? Freddie Mac first started keeping detailed records of mortgage rates on a weekly basis in 1971 . It is from this record that we are able to speak to specific dates and the rates that were available at that time. Based on the mortgage data taken from the last fifty-two years, the average mortgage rate is: 7.74%. This will give us a baseline for the mortgage rates that follow. Also, for this look back, we'll be using the 30-year fixed rate mortgage so that we have an apples-to-apples comparison. The lowest rate Now that we know the historical average, what week were interest rates at their lowest? A surprise to no one, this came during the pandemic. With so many people in the workforce sheltering in place, the economy took a downturn. In an attempt to stimulate the economy, and encourage people to make large purchases that would require a loan, the FED lowered interest rates. This culminated in the rates for a 30-year fixed-rate mortgage hitting 2.65% during the week of January 7–13, 2021. So, if you locked in your rate just as Mariah Carey's "All I Want for Christmas Is You" was leaving the #1 spot on the charts that year (it’s true, you can find that here ), you likely got the lowest of the low interest rates. The highest rate Conversely, the highest mortgage rate in history arrived in the early '80s. It should be said that mortgage rates do not directly correlate with the economy of the time, but it is difficult to separate them. Today, we might think of interest rates as being an inverse to the health of the economy. The lower they are, such as in our example above, the worse off we are economically. A higher interest rate might not always show a strong economy, but does often show an attempt to curb inflation, such as the current actions of the FED. The same was not true when the highest of the highs arrived. Inflation skyrocketed across the board in the wake of the second oil crisis of 1979. Mortgage rates were no different. The week of October 9–15, 1981, the interest rate continued to climb, ballooning up to 18.63%! If "Endless Love," the duet between musical legends Diana Ross and Lionel Richie , was playing on the radio when you were closing on your loan – ouch. Thankfully, in early December of that year, interest rates had come down by 1.73% to 16.9%, likely causing a wave of refinances on recent mortgages. More on that in a moment. Where we are now So, that's a look at the top highs and lows, but that naturally leads to the question: Where are we now? As of the time of this writing, mortgage rates sit at 6.96%*. Obviously that's a far cry from where we were a little over two years ago, but it is light-years away from the rates in October of 1981. The current rate is far closer to the low end than it is to the high end. Notably, the current rate is also under the historical average. If the FED goes ahead with raising rates later this year, as they've indicated that they will, we could see rates hovering closer to the historical average. (Also, to complete the musical comparison from above, the #1 song at the time of this writing is " Last Night " by country music star, Morgan Wallen.) Dating the Rate If there's one certainty when it comes to mortgage rates, it's that they will change. Whether up or down, rates are always in motion; they rarely if ever sit still for very long. If you are thinking of buying a home, but are put off by the current housing market conditions, don't let rates stop you from enjoying all the benefits of homeownership. Remember, you always have the option of refinancing once rates are more advantageous to you. Usually, that's about 0.5% to a full percentage point below the rate at which your loan closed. Even though that might not seem like a lot at first glance, it can add up to significant savings over the life of your loan, especially with a 30-year mortgage. This option to refinance has led to the saying, "Date the rate, but marry the home." In today's housing market, those are definitely words to live by. Conclusions Owning a home is all about the long game. Building equity takes time, attention and patience. The same is true of getting the best rate you can, either initially or through a refinance later on. If our discussion here has shown us anything, it's that rates will eventually go down. So, it becomes a matter of owning a home so that you can ride that downward trend when it finally arrives. A study of interest rates comes down to this: Don't let a temporary rate make the choice for you. Interest rates should never keep you from getting the home you really want. If you have questions about obtaining a mortgage and want to know all your options, our Finance partners are here to help you navigate your way. Contact us today.

10 Jul, 2023

Nestled on the scenic Eastern Shore of Maryland, Kent Island and the charming town of Stevensville offer a delightful escape for locals and visitors alike. Whether you're seeking outdoor adventures, entertainment, or family-friendly activities, this picturesque region has something for everyone. Join us as we uncover some of the best things to do in this vibrant area. Fun Things to Do Outside / Outdoor Activities Embrace the Waterfront Beauty Kent Island is surrounded by the majestic Chesapeake Bay, providing ample opportunities for water-based activities. Rent a kayak or paddleboard and explore the serene coves and inlets, taking in breathtaking views of the bay. If you’re looking for some fun on the water, Kent Narrows Public Landing is a great location for boaters looking to cruise east toward Queenstown, north toward Rock Hall, or out into the open waters of the Chesapeake Bay. Fishing enthusiasts can cast their lines from the pier or charter a boat for an exciting deep-sea fishing expedition. Explore the Island Trails Lace-up your sneakers or hop on a bike and embark on the scenic Cross Island Trail . This 6-mile paved trail stretches across Kent Island, offering a fantastic opportunity to immerse yourself in nature. Enjoy the lush greenery, spot local wildlife, and pause at picturesque overlooks along the way. South Island Trail, also in Stevensville, is a 7-mile paved trail that runs parallel to Route 8, beginning at Matapeake State Park and ending at Romancoke Fishing Pier. Explore Terrapin Nature Park Located on the northern tip of Kent Island, Terrapin Nature Park is a haven for nature enthusiasts. Take a leisurely stroll along the trails, observe native wildlife, and discover hidden beaches. The park also features picnic areas, a playground, and bird-watching opportunities, making it a perfect spot for a family outing. Things to Do for Adults / Nightlife / Entertainment Savor Local Cuisine and Brews Kent Island and Stevensville boast a diverse culinary scene. Explore local restaurants and sample fresh seafood delicacies, including Maryland's famous blue crabs. Additionally, indulge in the thriving craft beer culture by visiting breweries like the popular Cult Classic Brewing or RAR Brewing . Hit the Jackpot at a Casino For a night of excitement and entertainment, head to the nearby casinos. The lively gaming venues feature slot machines, table games, and live entertainment. Test your luck at the Hollywood Casino Perryville or the newly opened Live! Casino & Hotel , where you can also catch a live performance or dine at one of the renowned restaurants. Unwind at Local Bars and Pubs Kent Island offers a selection of charming bars and pubs where you can relax and enjoy the local atmosphere. From waterfront taverns with stunning views to cozy sports bars, there's a venue to suit every taste. Grab a refreshing drink, mingle with the locals, and soak up the vibrant nightlife. Things to Do for Families / Family-Friendly Activities Visit the Chesapeake Bay Environmental Center Engage your family in an educational and fun experience at the Chesapeake Bay Environmental Center . Discover the region's diverse ecosystems through interactive exhibits, guided nature walks, and hands-on activities. Don't miss the chance to explore the fascinating Marshy Creek, home to an abundance of wildlife. Enjoy Fun in the Sun at Matapeake State Park Matapeake State Park is an ideal destination for a family day out. Relax on the sandy beach, swim in the calm waters, or have a picnic in the park's shaded areas. The park also features a playground, volleyball courts, and hiking trails, ensuring there's something to keep everyone entertained. Discover Local History Step back in time and explore the historic district of Stevensville. Take a leisurely stroll along the charming streets lined with beautifully preserved buildings from the 18th and 19th centuries. Visit local museums and learn about the area's rich heritage, or enjoy shopping for antiques and unique crafts in the quaint boutiques. If you're in the Easton, MD Area, make time to see the Talbot Historical Society which explores the special culture of life lived on land and the water. You can easily spend an entire day here learning about the history of Talbot County which dates back to 1634. The Talbot Historical Society is a campus featuring the Mary Jenkins House, The James Neall House, The Hill Research Center, and The Gardens. Kent Island and the Stevensville area offer a wealth of exciting activities for outdoor enthusiasts, adults seeking entertainment, and families looking for fun-filled adventures. Whether you're drawn to the beauty of the Chesapeake Bay, the vibrant nightlife, or the family-friendly attractions, this picturesque region promises unforgettable experiences. So, pack your bags, embrace the charm of Kent Island and Stevensville, and get ready to create lasting memories in this delightful corner of Maryland.

Quick Links

Join Our List!

Provide your email address to be notified about new communities, incentives, and homesite releases.

BDX Forms

Elevations, floorplans and renderings may not be reproduced without the express written consent of Lacrosse Homes. All content, features and pricing is subject to change without notice.

© 2024

All Rights Reserved | Lacrosse Homes